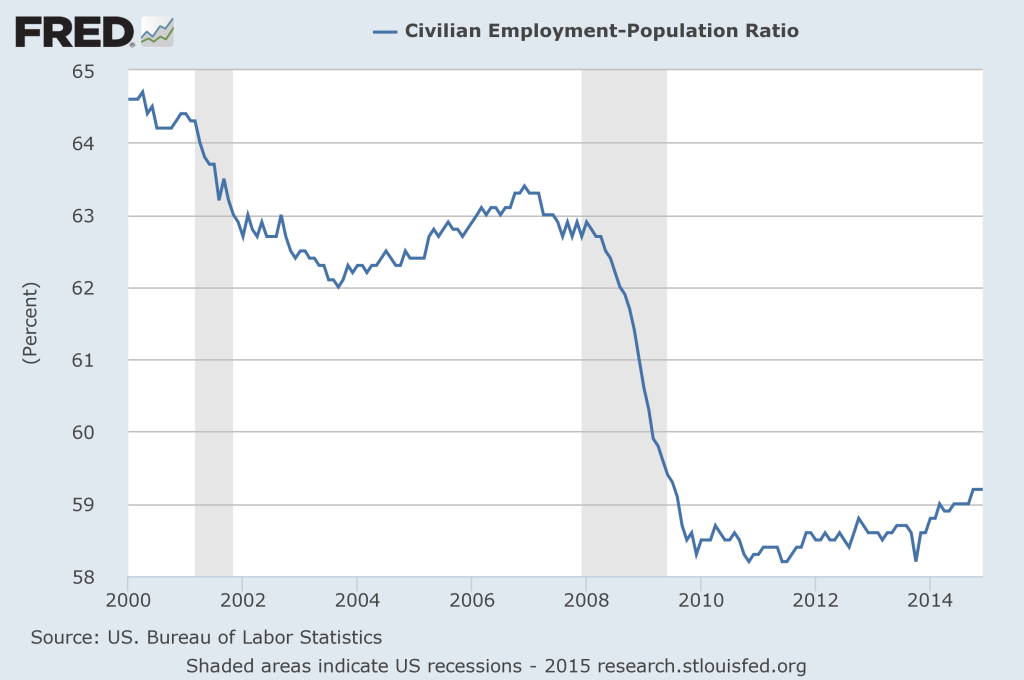

Seattle Restaurants Close Doors as $15 Minimum Wage Approaches

Seattle’s $15 minimum wage law goes into effect on April 1, 2015. As that date approaches, restaurants across the city are making the financial decision to close shop. The Washington Policy Center writes that “closings have occurred across the city ..