The Grexit Into Gold-backed Drachma Conspiracy Theory – or Plan Z

By Reggie Middleton | Zero Hedge

From Wikipedia:

Plan Z during 2012

“Plan Z” is the name given to a 2012 plan to enable Greece to withdraw from the eurozone in the event of Greek bank collapse.[16] It was drawn up in absolute secrecy by small teams totalling approximately two dozen officials at the European Commission (Brussels), the European Central Bank (Frankfurt) and the IMF (Washington).[16] Those officials were headed by Jörg Asmussen (ECB), Thomas Wieser (Euro working group), Poul Thomsen (IMF) and Marco Buti (European Commission).[16] To prevent premature disclosure no single document was created, no emails were exchanged, and no Greek officials were informed.[16] The plan was based on the 2003 introduction of new dinars into Iraq by the Americans[16] and would have required rebuilding the Greek economy and banking system ab initio, including isolating Greek banks by disconnecting them from theTARGET2 system, closing ATMs, and imposing capital and currency controls.[16]

Wolfson economics prize

In July 2012, the Wolfson economics prize, a prize for the “best proposal for a country to leave the European Monetary Union,” was awarded to a Capital Economics team led by Roger Bootle, for their submission titled “Leaving the Euro: A Practical Guide.”[19] The winning proposal argued that a member wishing to exit should introduce a new currency and default on a large part of its debts. The net effect, the proposal claimed, would be positive for growth and prosperity. It also called for keeping the euro for small transactions and for a short period of time after the exit from the eurozone, along with a strict regime of inflation-targeting and tough fiscal rules monitored by “independent experts.”

The Roger Bootle/Capital Economics plan also suggested that “key officials” should meet “in secret” one month before the exit is publicly announced, and that eurozone partners and international organisations should be informed “three days before.” The judges of the Wolfson economics prize found that the winning plan was the “most credible solution” to the question of a member state leaving the eurozone.

… In February 2015 the Russian government stated that it would offer Greece aid but would only provide it in rubles.[31]

Kathimerini reported that after the 16th February Eurogroup talks Commerzbank AG increased the risk of Greece exiting the euro to 50%.[32] The expression used by TIME for these talks is “Greece and the Euro Zone dance on the precipice”.[33]

Effect upon the European economy

Claudia Panseri, head of equity strategy at Société Générale, speculated in late May 2012 that eurozone stocks could plummet up to 50 percent in value if Greece makes a disorderly exit from the eurozone.[34]

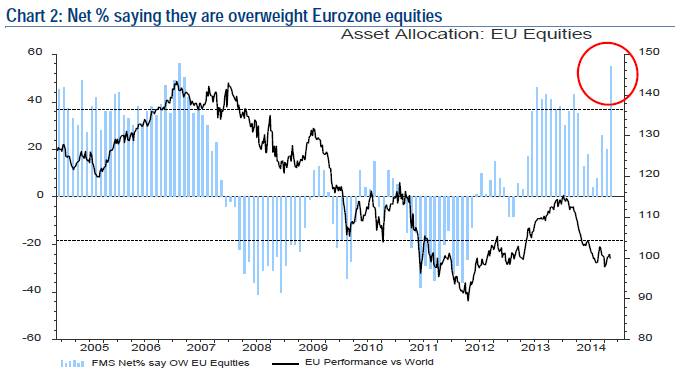

Wait a minute! That’s not possible. Goldmans Sachs says to buy EU eqities because of ECB QE and NIRP! We all know Goldman Sachs is always right, that’s why more than half of hedge funds are following suit…

After all, do you remember Goldman’s recommendation to sell the Swiss Franc? It worked out excellente’, reference When Everybody Thinks They’re Right, They’re Almost Guaranteed to be Wrong! I Think This Is The Biggest Bubble In World History.

Bond yields in other European nations could widen 100 basis points to 200 basis points, negatively affecting their ability to service their own sovereign debts.[34]

Hopefully with no correlation whatsoever to US-based debt, cause Goldman also recommended – Long U.S. High-Yield credit risk: The recent underperformance of the U.S.High-Yield market should prove transitory, the bank reckons. I addition, what will the ECB do after all of this QE and NIRP if bond yields spike anyway? Well.. More NIRP and QE of course!