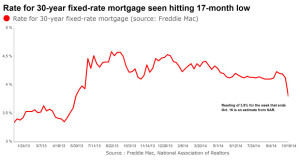

30-Year-Mortgage Rate Seen Hitting 17-month Low of 3.8%

By RuthMantell

WASHINGTON (MarketWatch) — Fresh worries over economic growth may lead to rates for the popular 30-year fixed-rate mortgage tumbling to a 17-month low, a drop that could spur additional refinancing, experts said Wednesday morning after data rattled investors.

The National Association of Realtors, which tracks sales of used homes (the largest part of the market) tweeted Wednesday morning:

Mortgage rate touches year low to 3.9% this week. On a 30-yr fixed rate.

— NAR Research (@NAR_Research) October 23, 2014

If the rate hits 3.8% today or Thursday, that would be the lowest reading since May 2013, according to a weekly gauge from federally controlled mortgage-finance giant Freddie Mac FMCC, -12.02% In Freddie’s latest reading, for the week that ended Oct. 9, the rate was 4.12%, one of the lowest results for 2014.

Here’s what’s happening: Changes in the rate for the popular 30-year fixed-rate mortgage closely track movements for the 10-year Treasury yield, which tumbled Wednesday morning on weakness in economic data.

Here’s what’s happening: Changes in the rate for the popular 30-year fixed-rate mortgage closely track movements for the 10-year Treasury yield, which tumbled Wednesday morning on weakness in economic data.

“It suggests a deceleration in terms of momentum,” said Ken Fears, an economist with NAR.

The recent drop in rates may spur more homes sales, though the labor market is much a larger factor when it comes to these big-ticket items. Meanwhile, experts said there could be another wave of refinancing applications.