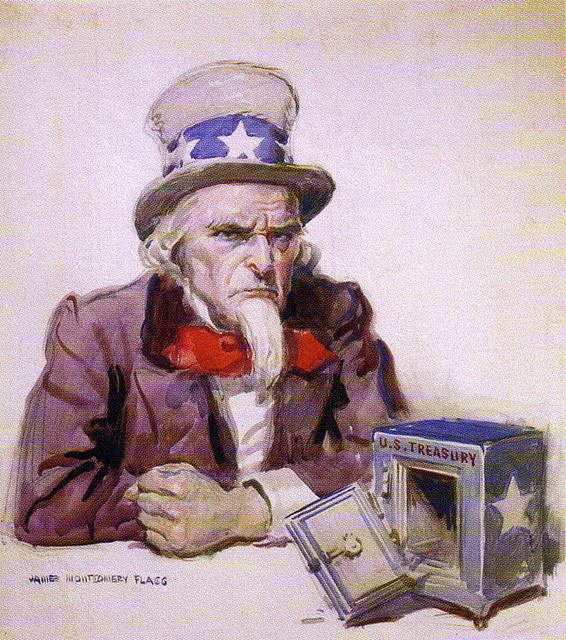

Who Owns America? CEDE & DTCC

By Greg Morse | Red Pill Reports

(RedPillReports) If You Have Stocks, Bonds Or Securities, You Do Not Own Them: Cede & Co. does.

Who Owns Your Residential Mortgage? Cede & Co. does.

Who Caused The Collapse Of The American Economy? DTCC, DTC & Cede & Co. did.

1. The Wall Street Stock Market System is a very well masked and very well developed extreme system of financial Asymmetric Warfare.

2. The definition of Asymmetric Warfare is the collection of protocols used to bring down a country and its society from within without using a preponderance of force.

3. What we, as Americans, have been taught for 100 years in reality is a lie wrapped in an enigma.

4. The sad and shocking reality is that NOTHING in our Country today is as it seems.

5. The formation of the infrastructure that has allowed the Wall Street Stock Market System to develop began in 1913 after the meeting at Jekyl Island and was followed by the subsequent Congressional Legislation that lead to the Formation of the Federal Reserve.

6. Once the Federal Reserve was formed and approved by Congress, the groundwork was laid for the financially related Asymmetric Warfare protocols to begin conducting the theft and confiscation of the majority of the financial and real assets in the Country from those Americans who have believed for the last 100 years that they were investing in the Country by buying stocks, bonds and securities on Wall Street.

7. The Federal Government cannot survive without the support of the Federal Reserve.

8. The Federal Reserve is a privately owned and controlled financial Godfather.

9. The Federal Government, through the Congress, and because of its bureaucratic, political and character impotence, voluntarily voted to give Legal Godfather status to the Federal Reserve.

10. What the Congress did was exactly what the German Congress did when they voluntarily voted to make Hitler a Dictator for life.

11. The Federal Government does not control the Federal Reserve.

12. The Federal Reserve controls the Federal Government.

13. The Federal Reserve controls the Federal Government by controlling ALL the money consumed by the Federal Government.

14. The Federal Reserve’s control of the Federal Government is manifested by the fact that, in 100 years, the Federal Reserve has never allowed itself to be fully audited.

15. The Federal Reserve discloses that it is controlled by its 12 Member Banks.

16. The question is, “Who owns and who is the controller of the 12 Member Banks?”

17. The answer is Cede & Co., as the sole Registered Shareholder, through its parent holding company the Depository Trust & Clearing Corporation.

18. Companies, including Banks, are ultimately controlled by their Shareholders not the BOD.

19. Money, Constitutional or fiat, is the grease which without, nothing happens.

20. The Federal Reserve, by its own disclosure, is controlled by its 12 Member banks which are owned, and therefore ultimately controlled, by their sole Registered Shareholder, Cede & Co.

21. Cede & Co. is the Nominee of the Depository Trust Company through which Cede & Co. becomes the sole Registered Shareholder of all companies trading securities on Wall Street.

22. The Depository Trust Company is a Member of the Federal Reserve.

23. The Depository Trust Company, with its parent holding company being the Depository Trust & Clearing Corporation, is by far the largest and singularly most powerful Member of the Federal Reserve.

24. Why? Because the DTCC, through its subsidiaries ACTUALLY owns the 12 Member Banks of the Federal Reserve.

25. Therefore, the Federal Reserve is controlled by the Holding Company DTCC.

26. The great majority of all financial activity in the Country, upon which the national economy depends, operates through, is obligated to and is controlled by Wall Street and the Congressionally passed Asymmetric Warfare supporting legislation that gives Wall Street the right to do whatever it desires.

Conclusions

1. The Golden Rule: He who owns the gold makes the rules and has the control.

2. Through its subsidiaries, the DTCC owns the majority of all private, public, civil and commercial financial and real assets in the Country.

3. The DTCC therefore EFFECTIVELY owns and, in ACTUAL REALITY controls Wall Street.

4. Since the DTCC, through its subsidiary the Depository Trust Company, is the largest controlling Member of the Federal Reserve, the DTCC controls the Federal Reserve.

5. The Federal Reserve controls the Federal Government by controlling its access to the funds LOANED to the Federal Government every single time the Federal Government needs so much as a single dollar.

6. These funds are LOANED to the Federal Government by the PRIVATE Federal Reserve.

7. The Federal Government must collateralize this debt, through its citizens, and pay the interest on these LOANED funds to the PRIVATE and DTCC controlled Federal Reserve.

8. This is why income taxes paid by Americans are paid to the Federal Reserve to service ONLY A PORTION of the interest on the debt owed by the Federal Government to the PRIVATE Federal Reserve.

9. Income taxes paid by Americans is insufficient to pay 100% of the annual interest charged on the principle debt owed by the Federal Government to the Federal Reserve.

10. The principle debt owed by the Federal Government to the PRIVATE Federal Reserve is not serviced or reduced by income taxes paid by Americans.

11. The integrity of America and what is supposed to be an open free capitalistic financial market has been decimated by the DTCC controlled Federal Reserve and the financial stranglehold it has on the Federal Government.

12. The breathtaking reality is that the Federal Government gave its blessing voluntarily and legislatively to the Federal Reserve to place this stranglehold on America and its citizens.

Major Players

U.S. Congress

Federal Reserve

Depository Trust & Clearing Corporation

Securities & Exchange Commission

The Depository Trust & Clearing Corporation

Depository Trust Company – (SRO)

Fixed Income Clearing Corporation – (SRO)

Mortgage Backed Securities Clearing Corporation

Cede & Co. As The Self Regulating Organization and Nominee for DTC

Euroclear: Formed by JP Morgan through its Brussels Morgan Guaranty Office

Clearstream: DTC Cohort and Collaborator in Europe

How Much Money Are We Talking About?

If $1 = .0034″ Thick, Then:

$1,000 is 1/3″ High

$1 Mil is 27′ High

$1 Bil is 5 Miles High

$1 Tril is 5,178 Miles High

$1 Quad is 5,178,000 Miles High

Fueling The Financial Asymmetric Warfare Plan

The Initial Public Offering

1. All companies and local, State and Federal governments issuing stock, bonds or securities does so through the Wall Street Stock Market System and become controlled by Wall Street.

2. How does Wall Street obtain the voluntarily participation by these entities such that these entities are willing to sell their souls to Wall Street?

3. The answer is money.

4. A company founder, as an entrepreneur, starts a company and develops a product or service that needs to be brought to market.

5. The founder does not have the money to develop and grow the company.

6. The largest volume of funding available to the founder is by developing an Initial Public Offering and selling it through the Wall Street Stock Market System.

7. As the IPO document is many hundreds of pages long and is predominantly composed of complex, contradictory and intense legalese, the founder, may not realize what he is doing by approving for sale the IPO developed by his legal counsel.

8. Unknowingly, the founder is giving up ownership of the company he founded in return for what is, in effect, an up-front financial payout of future profits not yet earned.

9. In many cases, this up-front payout of not yet earned future profits is the founder’s motivation.

10. After the founder realizes his up-front payout, if he is contracted to stay on as the Chairman, CEO or in another executive capacity, he will consider this additional financial compensation as gravy.

11. In many cases, after the up-front payout is realized, the founder is effectively paid off, has made a huge profit and does not care if he stays on with the company.

12. A recent example is Facebook founder Mark Zuckerburg who, in less than 2 hours, went from being a person of average means to being worth $2 Billion.

How Wall Street Gets Control

1. Before the IPO is offered through a Wall Street exchange, the offering company creates the original Equity stock that represents true ownership of the company as it exists prior to the IPO being formalized and offered for sale.

2. By SEC law and Wall Street procedure, before the IPO is released for sale, a binding contract MUST be executed with at least one Wall Street exchange, all of which are owned and controlled by the DTCC.

3. After Contract execution and prior to IPO offering release, all original hard copy shares representing actual equity ownership of the company must be physically delivered to the exchange(s) conducting the IPO.

4. After receipt of the original equity shares, the exchange declares itself the Sole Depository for all hard copy shares.

5. The exchange is now the Legal owner of the company.

6. At this point, the common man’s ability to own actual equity in the company ceases to exist.

7. Pursuant to the Securities Act of 1934, the SEC notifies the exchange that it cannot simultaneously own and trade the equity shares.

8. The SEC notifies the exchange that it can transfer ownership of the equity shares to the Nominee of the exchange.

9. As the sole Nominee for all exchanges, the equity shares are transferred to Cede & Co.

10. Cede & Co. now becomes the Sole Registered Shareholder of the company.

11. The exchange retains physical custody of the equity shares during the IPO offering period.

12. Cede & Co., as the Sole Registered Shareholder and for the purpose of giving the exchange something to sell as a shill commodity, creates one (1) electronic only share certificate referred to as the Street Name Stock.

13. The Securities Act of 1934 as amended requires that all traded shares must be delivered to the buyer in 1 to 3 days.

14. Therefore, Cede & Co., electronically trades only the Street Name Stock on the DTC- owned exchange.

15. Cede & Co. trades its Street Name Stock on the exchange floor as the meeting place for all sales and trades.

16. The DTC keeps its trading protocols private such that outside parties are precluded from discovering what goes on behind closed doors and keeps the public from becoming aware of these acts.

17. By written contract, Cede & Co. may only sell its electronic only Street Name Stock to direct and indirect Members of the DTC on the DTC owned exchange trading floor.

18. Members of DTC may only trade and sell their electronic Street Name Stock to other DTC Members or to Cede & Co.

19. Therefore, this closed-loop sales system keeps the electronic Street Name Stock in the DTC Member family and directly under the control of Cede & Co.

20. Only Cede & Co., as the Sole Registered Shareholder who actually owns the company, can give Beneficial Ownership Rights to any subsequent buyer.

What Are Beneficial Ownership Rights

1. Beneficial Ownership Rights represent the right to vote by Proxy when that Proxy is ONLY authorized by the Registered Shareholder.

2. Beneficial Ownership Rights are those revocable and cancellable rights to receive the major portion of a dividend, if declared. Beneficial Ownership Rights have nothing to do with Ownership of the Actual Equity Shares that represent Actual and Perfectible Ownership in the company.

3. This extremely important clarification between Actual and Perceived Ownership of Equity Shares representing Ownership in the company is the basis for the Wall Street System being able to bilk and acquire most of the wealth in the Country.

4. Thousands of these transactions take place each business day are done so in the black and go unchallenged by the American Public.

5. This is the primary reason that, since the majority of the American Public typically doesn’t read or study and is ignorant of this legal reality, Cede & Co. has basically been able to acquire and steal the ownership of America.

6. The American Public, thinking they are buying Actual Equity Share Ownership, is being mislead and set up just as American homebuyers were in the Mortgage Crisis.

7. Most Public Buyers accept the assurances of their Brokers and others and never read or research to ascertain the factual reality that they are buying NOTHING of actual collateralized value.

8. Beneficial Ownership Rights provide for the revocable opportunity to receive the net majority of declared and paid dividends.

9. These rights can be terminated without notification to or recourse by the common man.

10. Payment of dividends pursuant to these Beneficial Ownership Rights is what keeps a financial revolution at bay.

11. These Beneficial Ownership Rights can only be held, in name only, by Members of the DTC.

12. The actual legal control authority over these Beneficial Ownership Rights is maintained by Cede & Co. as the Sole Registered Shareholder only and not to either the equity shares or the Street Name Stock that are owned by Cede & Co.

13. By written contract, Cede & Co. will only give Beneficial Ownership Rights to those DTC Members who have purchased the Street Name Stock from Cede & Co.

14. Derivatives, as a trading commodity, are literally a figment of the imagination.

15. The Street Name Stock sold to DTC Members is the 1st Derivative since the Street Name Stock has no connection to any physical assets of the company.

16. Without the fallacious Street Name Stock being generated by Cede & Co., there would be no Paper to sell to the public and the IPO would generate no money.

17. The public is of the belief they are buying ownership in the company but this is a lie.

18. At this point, once DTC Members receive their portions of the Street Name Stock, the IPO is announced.

19. DTC Members owning the Street Name Stock now sell ONLY Beneficial Ownership Rights to the public.

20. The public buys the 2nd derivative, or 2nd figment of the imagination, and receives only the revocable and cancellable Beneficial Ownership Rights to receive the net majority of declared and paid dividends.

21. Regarding REMIC Trusts, as an example, In Exhibit 619, Page 369, Paragraph 2, it states:

“If issued in book-entry form, the classes of a series of certificates will be initially issued through the book-entry facilities of The Depository Trust Company, or DTC. No global security representing book-entry certificates may be transferred except as a whole by DTC to a nominee of DTC, or by a nominee of DTC to another nominee of DTC. Thus, DTC or its nominee will be the only registered holder of the certificates and will be considered the sole representative of the beneficial owners of certificates for all purposes.”

22. In other words, only the DTC and Cede & Co. may distribute Beneficial Ownership Rights.

23. Therefore, the only Beneficial Owners, in all cases, will be the Direct or Indirect Participants in the DTC that are completely managed, controlled and regulated by the DTC for its own benefit.

24. If the DTC ceases to be the Sole Depository of the Securities, the following occurs in the case of a RMBS or REMIC Trust. In Exhibit 619, Page 370, Paragraph 2, it states:

“Prior to any such event, beneficial owners will not be recognized by the trustee, the master servicer, the servicer or the Certificate Administrator as holders of the related certificates for purposes of the pooling and servicing agreement, and beneficial owners will be able to exercise their rights as owners of their certificates only indirectly through DTC, participants and indirect participants.”

25. Since the Holder of the Beneficial Ownership Rights is given these rights only by the DTC and Cede & Co., the parties in the RMBS or REMIC Trust legally CANNOT recognize Beneficial Owners as having any Shareholder Rights in the RMBS or REMIC Trust.

26. Regarding Securities, as an example, In Exhibit 42, Page 9, Paragraph 9, the World Gold Trust, L.L.C. states that:

“Purchases of Securities under the DTC system must be made by or through Direct Participants, which will receive a credit for the Securities on DTC’s records. The ownership interest of each actual purchaser of each Security (“Beneficial Owner”) is in turn to be recorded on the Direct and Indirect Participants’ records. Beneficial Owners will not receive written confirmation from DTC of their purchase.”

27. This is a Fraudulent representation since ONLY the Registered Shareholder may grant Beneficial Ownership Rights. World Gold Trust, L.L.C. clearly states that Cede & Co. is the ONLY Registered Shareholder.

The DTCC Is The Control Pyramid

1. According to the most recent reports as of the end of 2012, the DTCC settled $1.88 Quadrillion in annual Securities Transactions.

2. $1.88 Quadrillion in Annual Settlements is equivalent to purchasing the entire United States General Domestic Product every 3 days.

3. The DTCC Depository is the largest Securities Depository in the World.

4. Additionally, the DTCC provides Custody and Asset Servicing for 3.5 Million Security Issues in the United States and 110 other Countries.

5. Lastly, the DTCC provides Custody, being equivalent to Cash On Hand, of Securities Issues equivalent to $30 Trillion US dollars.

6. That $30 Trillion is equivalent to 3X the value of all active residential mortgages in the United States.

7. Of shocking note, although the DTCC was only 10 blocks from the World Trade Center when Lower Manhattan was blocked off to all but emergency personnel for a number of days after 9-11, SOMEHOW the DTCC still settled on 9-12-2001, the day after the attack, $280 Billion in Securities Transactions completed on Friday, 9-8-2001 and ON THE DAY OF THE ATTACK Monday, 9-11-2001.

The Unknown Secret Cause Of The Mortgage Crisis

Residential Mortgages were ultimately destroyed by the Wall Street Stock Market System. It is necessary to be aware of certain astounding facts about how the Wall Street Stock Market System operates and to realize that these facts, for decades, have been INTENTIONALLY KEPT IN THE BLACK and away from the American Public.

1. The true nature of what you, as a Public buyer of stock, is actually buying has been intentionally and strategically kept from the American Public for decades.

2. Some of our deep Wall Street insider sources have personally told me that they estimate that less than 0.03% (3 out of every 10,000) of licensed professionals working on Wall Street even know about what you are going to be informed of.

3. When you buy stock, contrary to your perception and what you have been taught, you are NOT buying an actual collateralized stock that represents an EQUITY ownership in the company.

4. When a stock is created, actual Equity Shares are developed which represent real ownership in the company.

5. The Securities Exchange Act of 1934 requires an actual physical delivery of hard copy Equity Shares transacted between the Buying and Selling parties.

6. Because this transfer is time consuming and expensive, an electronic Book-Entry-Only System, which MERS appears to have copied and perfected for the residential mortgage market, was established in which hard documents are replaced by electronic files.

7. Actions detrimental to the American Public take place in which actual ownership of the company is taken by those who DID NOT pay for the ownership position and those that DID pay have their ownership positions stolen and are put into positions of risk about which they know nothing.

8. The physical shares representing the actual Equity Ownership in the company are entered into the electronic Book-Entry-Only System.

9. Once entered, the Brokers and Banks selling to the Public do not sell the physical shares representing the actual Equity Ownership in the company. They sell the electronically generated shares that are termed Street Name Stock.

10. These electronic Street Name Stocks are themselves Derivatives since they DO NOT represent and are NOT tied to any actual Equity Asset.

11. As a sale is made to a Public buyer, simultaneously, the Broker buys the Street Name Stock for the Broker’s own trading account.

12. The Public buyer actually purchases a REVOCABLE or CANCELLABLE right to receive the largest portion of declared dividends paid. The Corporation DOES NOT have to declare a dividend.

13. Since the Broker owns the Street Name Stock for his own trading account, the Broker actually purchases and owns the Beneficial Ownership Rights.

14. Beneficial Ownership Rights may be revoked at any time, without cause or warning, by the Registered Shareholder.

15. Usually there is ONLY 1 Registered Shareholder and that is Cede & Co.

16. Due to the existence of specific language contained in all Stock, Municipal Bond, Government Securities and Mortgage Backed Securities offering prospectuses, the Registered Shareholder becomes the actual Stock Exchange on which the Stocks, Bonds or Securities are traded.

17. All Exchanges require that all Members and Participants trading on that Exchange designate the Exchange as the Registered Shareholder of all traded Stocks, Bonds and Securities.

18. Since all Exchanges are Private-Member-Only Organizations, they maintain the right to decree their own rules of Membership just like a country club.

19. The Securities & Exchange Commission, under the auspices of the Securities Exchange Act of 1934, as subsequently amended by Congress and signed into law by the President, can designate an Exchange as a Self Regulating Organization.

20. When an Exchange becomes a Self Regulating Organization, the Federal Government protects the Exchange in the development of the Exchange’s own Self-Developed and Self-Enforced Rules and Regulations.

21. Being a Sole Depository of shares ideally positions the Exchange to be declared a Self Regulating Organization by the Securities & Exchange Commission or other Federal Regulatory body.

22. The Securities & Exchange Commission actually promotes Exchanges into becoming Sole Depositories.

23. The Securities & Exchange Commission has endorsed the protocol chosen by Wall Street Stock Market Controllers of placing Equity Shares in the vaults of a Central Depository and transferring the claims against the Depositories accounts rather than the Equity Shares themselves.

24. The Securities & Exchange Commission endorses and supports the goal of removing the Ownership of companies from the common man on the street who believes he is purchasing Equity Shares.

25. The effect of being the Sole Depository of the actual Equity Shares representing true Ownership in the Company is that the Exchange becomes the Registered Shareholder of the Equity shares.

26. The Securities Exchange Act of 1934 precludes an Exchange from owning the Shares it trades.

27. Therefore, and this is the KEY POINT, the Exchange must simultaneously relinquish Share Ownership to its supposedly Independent Nominee CHOSEN by the Exchange itself.

28. The Exchange-chosen Nominee becomes the equity-owning Registered Shareholder of the company and issues the electronic Street Name Stock.

29. The effect is that the Nominee that has a binding legal relationship with the Exchange is the actual and Sole Owner of the company.

30. The electronic Street Name Stock represents the GRANTING of REVOCABLE and CANCELLABLE Beneficial Ownership Rights to Members of the Exchange who purchase the Street Name Stock for their own trading account.

31. The Public buyer is actually buying nothing more than the REVOCABLE Non-Equity right to receive dividends, if so declared.

32. Beneficial Ownership Rights may be terminated at any time without cause or notification by the Registered Shareholder.

33. Neither the Public buyer nor the Members of the Exchange have any legal recourse for fraud, loss or damage.

34. The Beneficial Ownership Rights can only be held by a Member of the Exchange on which the trading is done.

35. Due to the existing separation between the actual Equity Shares and the electronic Street Name Stock, the Board of Directors of the company is not required by Federal or State law to notify the Public of any changes in corporate Board governance or Shareholder meetings.

36. The company creates Equity Shares. The Nominee of the Exchange creates the electronic Street Name Stock.

37. The electronic Street Name Stock has NO relationship to the actual Equity Shares created by the company.

38. The Securities & Exchange Commission approves and endorses this procedure.

39. The Securities & Exchange Commission requires that the company notify the Registered Shareholders of all changes in Corporate Board governance and Shareholder Meetings.

40. Because the Holders of the Beneficial Ownership Rights receive these rights from the Nominee of the Exchange and NOT the company, Federal Law mandates that the Board Of Directors cannot communicate with the Beneficial Ownership Rights owner.

41. The Securities & Exchange Commission then requires the Registered Shareholder, being Cede & Co., to vote whether or not they will issue Voting Proxies to the Holders of the electronic Street Name Stock and these Holders are actually the Brokers and Banks who sold the electronic Street Name Stock to the Public.

42. Because the Public has solely purchased the right to receive a dividend check and their identity is only known by the Brokers and Banks who sold the electronic Street Name Stock, there is no direct communication allowed by Federal and State law between the Public who bought the Street Name Stock and the Board of Directors of the company.

Self Regulating Organizations

1. The Depository Trust & Clearing Corporation is a Holding Company that owns, controls and supports 6 primary wholly-owned Operating Subsidiaries that carry out their marching orders, insure the ever-increasing reach and control of the DTCC and insulate the DTCC from both public and private scrutiny.

2. The DTCC is effectively the single most powerful, Government protected and sanctioned, monopolistic Stock Market controller in the United States and most of the World .

3. These 6 DTCC subsidiaries are:

a. Depository Trust Company (DTC)

b. National Securities Clearing Corporation (NSCC)

c. Fixed Income Clearing Corporation (FICC)

d. DTCC Solutions, L.L.C.

e. DTCC-Deriv/SERV, L.L.C.

f. European Central Counter Party Limited Euro/CCP

4. Through this strategically linked set of wholly-owned subsidiaries, the DTCC controls virtually all United States and European Securities Trading in Corporate Stocks, Municipal Bonds, Derivatives, Government Securities and Residential Mortgage Backed Securities.

5. Based on its massive trading volumes, it can be said that the DTCC effectively controls the majority of all worldwide Securities Trading.

6. In June, 1980, the Securities & Exchange Commission determined that “Clearing Agencies… are essential to Congressional Policy to reduce the physical movement of Securities Certificates.”

7. Because Clearing Agencies use proprietary databases, the Public has no legal right to review or analyze the contents of these databases. Does this sound familiar with what we know about MERS?

8. Therefore, the Clearing Agency can operate in the black.

9. In 1983, the Depository Trust Company was given Self Regulating Organization status by the Securities & Exchange Commission.

10. This was one of the acts by the SEC that paved the way for Wall Street to go black and continue withholding from the Public the reality of the risks posed to the Public by the Wall Street system.

11. The Securities Exchange Act of 1934, as amended by Congress and signed into law by the President, requires all Security Broker-Dealers to be Members of at least 1 Self- Regulating Organization.

12. You may confirm this fact by reviewing 15 USC Section 78f(b)(1) and 15 USC Section 78o-3(b)(2).

13. This is tantamount to being forced to join the Mafia such that you will then be required to follow their self-made and self-regulated rules that insure the perpetuation of the fraudulent and in the black system.

14. These Rules have the FULL endorsement of the SEC and the Federal Government.

15. The tradeoff to these Members by participating is that they are allowed to trade and get a paycheck.

16. The United States Congress defines Self Regulating Organization Members as:

a. Natural persons trading on the floor.

b. The associated Brokerage Firm that employs the floor trader.

c. Any Broker or Dealer who agrees to be regulated ie. follow the mafiosi rules.

d. Any Broker or Dealer with whom the Exchange or Association undertakes to enforce compliance with the provisions of the Securities Exchange Act of 1934, the Rules and Regulations thereof and the Rules of the Exchange.

17. The Federal Government endorses these rules and requires that all Broker-Dealers must follow these Self-Generated and Self-Regulated rules ONLY.

18. The United States Supreme Court, in Credit Suisse First Boston vs Billing, 426 F3d 130 (2nd Circuit 2005), granted Antitrust law compliance exemption to ALL Financial Self Regulating Organizations.

19. In other words, a Government pardon has been given and immunity from State and Federal prosecution for crimes has been granted to these Self Regulating Organizations.

20. In the wake of the Market Crash of 1929, Self Regulating Organizations were given the authority to monitor their own compliance and were given the legal ability, with economic incentives, to discipline their own non-compliant Members.

21. In other words, Self Regulating Organizations who operate with no external oversight, now control and decide if any of their country club brothers are to be disciplined.

22. The 2008 Mortgage crisis cryptically tells us this policy of letting the foxes guard the henhouse was designed to fail from the outset.

23. Self Regulating Organizations are responsible for developing and enforcing their own rules that govern the legal relationship between SRO Members and their Public customers.

24. Self Regulating Organizations are Gatekeepers. SROs develop minimum standards for listing Securities to create a reasonable expectation that the Securities will trade in a “Liquid Secondary Market.” If adequate sizzle and hype are not generated to insure continued trading, the Exchange will not allow the Securities to be traded on the floor.

25. The first rule of Stock and Exchange trading is that “you must first find a bigger fool than yourself.”

26. The Depository Trust Company claims its authority to operate as an SRO under 15 USC Section 78q-1.

27. This is another example of the Federal Government passing legislation which grants powerful people and entities to operate, to the detriment of the American people, without oversight or the fear of prosecution.

28. Therefore, the door to corruption is wide open.

29. The question becomes, “Who’s interest is the Federal Government working to protect?”

30. The Fixed Income Clearing Corporation, a subsidiary of the DTCC, is an SRO and contains 2 wholly-owned divisions.

31. The first is called the Government Securities Clearing Corporation and is a Self Regulating Organization.

32. The second is called the Mortgage Backed Securities Division.

33. As of May, 2010, the MBSD applied to the SEC to become a Central Counter Party Servicer which then positions the MBSD to be classified as an SRO in the future.

34. On June 9, 2009, Larry Thompson, the General Counsel and Managing Director of the Depository Trust & Clearing Corporation, urged Congress to make the DTCC the Mandatory Sole Depositor and SRO for all Over-The-Counter Derivative Trading.

35. In 2008, the Over-The-Counter Derivatives market had transaction revenues of almost $700 Trillion.

36. The National Securities Clearing Corporation is a subsidiary of the DTCC and is an SRO.

37. All Securities Trading in the United States is effectively controlled by the DTCC.

38. The NSCC clears and settles virtually all Broker-To-Broker equity, corporate bond and municipal bond trades in the United States.

39. All Securities in the United States, without the Public knowing it, are traded between Broker-Dealers before the Public has an opportunity to purchase ANYTHING.

40. The NSCC was incorporated in 1976 to work in tandem with the DTC to consolidate and handle the clearing and settlement of both Listed and Over-The-Counter Securities transactions.

41. This means that these 2 DTCC organizations clear and control all Securities transactions in the United States.

42. This represents a true Monopoly that has been granted immunity from prosecution under parts of US Antitrust laws by the US Supreme Court.

43. The DTCC Global Trading Repository serves as the industries preferred provider for Global Over-The-Counter Derivatives reporting.

44. Therefore, the DTCC becomes an unnamed Co-Conspirator in any Racketeering.

45. The DTCC Global Trading Repository holds data on more than 98% of Credit Default Swaps, 70% of Interest Rate Derivatives and 60% of Equity Derivatives traded Globally.

46. The Mortgage Crisis of 2008 was directly caused by the improper and illegal use of Credit Default Swaps and Interest Rate Derivatives.

47. It now appears very likely that much of the mortgage related information homeowner’s have been attempting to find all along has been being held in the black by the DTCC, its Global Trading Repository and its Subsidiaries.

48. Those of us attempting to locate and acquire mortgage documents have apparently been looking in the wrong place and have allowed many of the major participants in the RICO Fraud to remain thus far untouched by Federal litigation.

49. The Economic Collapse in Europe was caused by the use of Equity Derivatives.

50. The DTCC is the first organization to receive regulatory approval in Japan to establish a Trade Depository Bank.

51. Therefore, the DTCC can determine who is allowed to trade with Japan.

Document Language

1. All prospectuses for Public Stock, Municipal Bonds, Government Securities and Mortgage Backed Securities Trust Agreements traded on a Securities Exchange operated by the Depository Trust & Clearing Corporation and/or its Subsidiaries must contain document language that describes the Depository Trust Company and its Book- Entry-Only issuance of Trading Certificates.

2. Document language demands that the Depository Trust Company will be the Sole Securities Depository for the Securities traded.

3. Document language used in all documents demands that ALL Securities issued will be Ownership Registered in the name of the Depository Trust Company’s Nominee, Cede & Co.

4. Document language states that Cede & Co. will issue ONLY 1 CERTIFICATE for each issue of Securities deposited with the Depository Trust Company.

5. This Certificate issued by Cede & Co. is a Derivative as it is not, in any way, related to Equity in the company.

6. If the aggregate value of the Securities issue is more that $500 million, Cede & Co. will issue 1 Certificate for $500 million and an additional Certificate representing the remaining principal amount of the Securities Offering.

7. Document language states that the Depository Trust Company is the WORLD’S LARGEST Securities Depository.

8. This statement tells the World that the DTCC is the supreme Godfather.

9. Document language describes the Depository Trust Company as a Limited Purpose Trust Company organized under New York State Banking Law.

10. Because the DTC is a Trust Company, the DTC holds the physical Equity for the Benefit of Cede & Co.

11. Document language defines the Depository Trust Company as a BANKING ORGANIZATION as proscribed by New York State Banking Law.

12. As a Banking Organization, the DTC is required to protect and develop the assets of its Customer who is Cede & Co.

13. Document language states that the Depository Trust Company is a MEMBER of the FEDERAL RESERVE.

14. We are beginning to see how closely tied Cede & Co. and the DTCC is to the heart of the fiat currency control system of the Federal Reserve that will not allow itself to be audited by the Public.

15. Document language defines the Depository Trust Company as a Stock and Securities CLEARING CORPORATION as described by the New York State Uniform Commercial Code.

16. This means that ONLY Trades approved by DTC are considered legitimate in New York.

17. Document language defines the Depository Trust Company as a CLEARING AGENCY as defined in Section 17A of the Securities Act of 1934 which is Title 15 of the United States Code.

18. This means that ONLY Trades approved by DTC are considered legitimate by the Federal Government.

19. Document language states that the Depository Trust & Clearing Corporation is owned by the Users of its Self Regulated Subsidiaries.

20. Note that the Publically Traded Securities of the Users of the Depository Trust & Clearing Corporation’s Self Regulated Subsidiaries are deposited with the Self Regulated Subsidiaries of the Depository Trust & Clearing Corporation.

21. These Securities, of the Holding Companies of the Users of the Regulated Subsidiaries, are ownership registered in the name of Cede & Co.

22. This means that Cede & Co. owns the Members.

23. A Direct Participant is a Broker-Dealer or financial institution that is a Member of the Depository Trust & Clearing Corporation.

24. Document language states that the purchase of Securities under the Depository Trust Company system can only be made directly or through the Direct Participants of the Depository Trust Company.

25. Direct Participants receive a CREDIT for the Securities traded on the Depository Trust Company record.

26. Document language states that a Broker-Dealer or financial institution who is not a Direct Participant in the Depository Trust & Clearing Corporation but maintains a Custodial Relationship with a Depository Trust & Clearing Corporation Direct Participant is deemed to be an Indirect Participant.

27. Regulations require that the Ownership of Beneficial Ownership Rights be recorded on the Direct and Indirect Participant’s Electronic Book-Entry-Only System.

28. However, this is NOT what actually takes place. The ownership of Beneficial Ownership Rights remain with the Direct and Indirect Participants and is NOT transferred to any Public buyer.

29. Ownership of the Equity Shares remains with Cede & Co.

30. This is a glaring example of the misrepresentation committed against the Public.

31. Due to the electronic Book-Entry-Only System, the Depository Trust Company and the company whose stock is being traded do not know who purchased the Beneficial Ownership Rights from the Direct or Indirect Participants.

32. Thus, a very effective firewall is created by the Book-Entry-Only System between the Beneficial Owners and the company whose Street Name Stocks are being traded.

33. To evidence how the Cede & Co. construct of actual Equity Share ownership and control is perpetuated and hidden from the Public and the World, in all areas of Stock Market and Securities Trading operations, what follows are current examples of how Cede & Co. owns and controls all areas of the United States Stock Market and the assets that the Public believes are owned by common man buyers.

REMIC Trusts & RMBS

1. The RALI Series 2008-QR1 REMIC, the Trust my mortgage is in, contains 3 sets of Residential Mortgage Backed Securities. The 1st is the RMBS that was created from February 2008 until May 2008 electing income tax exempt status based on Federal Income Tax law as it applies to REMIC and Real Estate Investment Trust entities. The 2nd is the RALI Series 2006-QS11 RMBS. The 3rd is the RALI Series 2006-QS12 RMBS.

2. The RALI Series 2006-QS11 and RALI Series 2006-QS12 RMBS are Certificate Pass- Throughs. This means that the outstanding Trust certificates are re-bundled with a new REMIC and the Owner of the Pass-Thru, Cede & Co., can realize new and higher profits and tax shelter benefits from rejuvenating these old RMBS into a new and higher rated REMIC.

3. The Prospectus Supplemental of the RALI Series 2008-QR1 REMIC is our Exhibit 619 in the Southern New York State District Court Appeal action of a ruling in the largest Bankruptcy in the history of the United States. In the REMIC TRUST Agreement, included in the Prospectus Supplemental on Page 35, 3rd and 4th Paragraphs from the bottom, the REMIC addresses the RALI 2008-QR1 REMIC certificates where it states:

“The certificates will be available only in book-entry form through facilities of The Depository Trust Company, or DTC, and are collectively referred to as the DTC registered certificates…”

“The DTC registered certificates will be represented by one or more certificates registered in the name of Cede & Co., as the nominee of DTC. No beneficial owner will be entitled to receive a certificate of any class in fully registered form, or a definitive certificate, except as described in the prospectus under “Description of the Certificates- Form of Certificates.”

4. This means that Cede & Co., and only Cede & Co., is the Registered Owner of the RALI 2008-QR1 REMIC certificates.

5. In Exhibit 619 on Page 130, Paragraph 1, the REMIC Trust discusses the ownership of the Series 2006-QS11 RMBS Pass-Thru certificates where it states:

“The DTC registered certificates are represented by one or more certificates registered in the name of Cede & Co., as the nominee of DTC. No beneficial owner will be entitled to receive a certificate of any class in fully registered form, or a definitive certificate, except as described in the prospectus under “Description of the Certificates-Form of Certificates.”

6. This means that ONLY Cede & Co. is the Sole Registered Owner of the Series 2006- QS 11 RMBS certificates and that ONLY Cede & Co. may grant Beneficial Ownership Rights to whomever it pleases.

7. In Exhibit 619, Page 258, Paragraph 1, the REMIC Trust discusses the ownership of the Series 2006-QS12 RMBS Pass-Thru certificates where it states:

“The DTC registered certificates are represented by one or more certificates registered in the name of Cede & Co., as the nominee of DTC. No beneficial owner will be entitled to receive a certificate of any class in fully registered form, or a definitive certificate, except as described in the prospectus under “Description of the Certificates—Form of Certificates.”

8. This means that ONLY Cede & Co. is the Sole Registered Owner of the Series 2006- QS12 RMBS certificates and that ONLY Cede & Co. may grant Beneficial Ownership Rights to whomever it pleases.

9. In Exhibit 619, Page 331, 3rd Paragraph from the bottom, global trading of the U.S. REMIC is discussed where it states:

“The global securities will be registered in the name of Cede & Co. as nominee of DTC. Investors’ interests in the global securities will be represented through financial institutions acting on their behalf as direct and indirect participants in DTC. Clearstream and Euroclear will hold positions on behalf of their participants through their respective depositories, which in turn will hold such positions in accounts as DTC participants.”

10. This means that Clearstream and Euroclear are extending the reach and control of Cede & Co. into the European market. Acting in this role as Participants in the DTC, Clearstream and Euroclear are the owners of the Beneficial Ownership Rights and these rights are never relinquished.

11. In a move designed to show adherence to European Union Securities Law, the DTC transfers only custodial rights to a portion of the REMIC Certificates traded in Europe. The Actual ownership of these certificates will forever remain with Cede & Co.

12. This is how the DTCC, its subsidiaries, affiliates, Euroclear, and Cleamstream successfully, and in the black, sold worthless American RMBS in Europe which sales subsequently caused the economic crisis and instability in all of Europe since 2010.

Municipal Bonds

1. In the Dekalb County Georgia Government Bond, Exhibit 45, Page 1, Paragraph 1, it states that the real owner of the Bonds issued is Cede & Co. and that DTC will get paid by the County:

“DeKalb County, Georgia (the “County”) will issue its Tax Anticipation Notes (the “Notes”) in fully registered form, without coupons, which will be registered in the name of Cede & Co. (the “DTC Nominee”), as nominee for The Depository Trust Company, New York, New York (“DTC”), which will act as securities depository for the Notes. Purchasers of beneficial ownership interests in the Notes (“Beneficial Owners”) will not receive physical certificates representing their ownership interests in the Notes purchased. So long as DTC or its nominee is the registered owner of the Notes, payment of principal and interest will be made directly to DTC.”

2. Dekalb County makes it perfectly clear in Exhibit 45, Page 7, Paragraph 1 that the Public will be purchasing a DERIVATIVE of the Original Municipal Bonds where it states:

“The Notes shall be originally issued as a single fully registered Note, to Cede & Co., the registered owner thereof, as nominee for The Depository Trust Company, New York, New York (“DTC”). See “THE NOTES–Book Entry Only System.” Beneficial ownership interests in the Notes shall be issued in denominations of $100,000 or any integral multiple of $5,000 in excess thereof. The Notes shall be dated as of the date of delivery thereof and payment therefore shall be payable in lawful money of the United States of America upon presentation thereof at the office of the Director of Finance of DeKalb County, Decatur, Georgia.”

3. In Exhibit 45, bottom of Page 7, Dekalb County states that the Public is purchasing Beneficial Ownership Rights:

“Purchases of Notes under the DTC system must be made by or through Direct Participants, which will receive a credit for the Notes on DTC’s records. The ownership interest of each actual purchaser of each Security (“Beneficial Owner”) is in turn to be recorded on the Direct and Indirect Participants’ records. Beneficial Owners will not receive written confirmation from DTC of their purchase.”

4. Since Cede & Co. is the Actual owner of the notes and is the only one who determines who receives Beneficial Ownership Rights, what is the Public actually buying?

5. In Exhibit 45, Page 8, Paragraph 1, Dekalb County does not care or even know who will have Beneficial Ownership Rights where it states:

“To facilitate subsequent transfers, all Notes deposited by Direct Participants with DTC are registered in the name of DTC’s partnership nominee, Cede & Co., or such other name as may be requested by an authorized representative of DTC. The deposit of Notes with DTC and their registration in the name of Cede & Co. or such other nominee do not effect any change in beneficial ownership. DTC has no knowledge of the actual Beneficial Owners of the Notes; DTC’s records reflect only the identity of the Direct Participants to whose accounts such Notes are credited, which may or may not be the Beneficial Owners. The Direct and Indirect Participants will remain responsible for keeping account of their holdings on behalf of their customers.”

6. Here’s how Ownership Voting on the Bonds takes place as described in Exhibit 45, Page 8, Paragraph 4:

“Neither DTC nor Cede & Co. (nor such other DTC nominee) will consent or vote with respect to the Notes unless authorized by a Direct Participant in accordance with DTC’s Procedures. Under its usual procedures, DTC mails an Omnibus Proxy to the County as soon as possible after the record date. The Omnibus Proxy assigns Cede & Co.’s consenting or voting rights to those Direct Participants to whose accounts the Notes are credited on the record date (identified in a listing attached to the Omnibus Proxy).”

Publicly Traded Stock

1. In Exhibit 42, Pages 1 & 2, World Gold Trusts Services, L.L.C. is selling publicly traded certificates. They state that Cede & Co. will own them:

“Prior to closing on the Securities on 11-8-04 there shall be deposited with DTC one or more Security certificates registered in the name of DTC’s nominee, Cede & Co., for each of the Securities with the offering value(s) set forth on Schedule A hereto, the total of which represents 100% of the offering value of such Securities.”

2. In Exhibit 42, Page 2, it is stated that Cede & Co. will issue certificates declaring that Cede & Co. is the entity who will get paid and only an authorized representative of the DTC can redeem this Security:

“Unless this certificate is presented by an authorized representative of The Depository Trust Company, a New York corporation (“DTC’), to Issuer or its agent for registration of transfer, exchange, or payment, and any certificate issued is registered in the name of Cede & Co. or in such other name as is requested by an authorized representative of DTC (and any payment is made to Cede & Co. or to such other entity as is requested by an authorized representative of DTC), ANY TRANSFER, PLEDGE, OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL inasmuch as the registered owner hereof, Cede & Co., has an interest herein.”

3. If you disbelieve or reject the conclusion that Cede & Co is the SOLE owner, carefully review Exhibit 42, Page 5, Paragraph 14 where it states:

“Reorganization payments resulting from corporate actions (such as tender offers or mergers) shall be received by Cede & Co., as nominee of DTC…”

Conclusion

In the United States, it now appears that ALL private, public, civil and commercial entities depending on the trading of Securities for their existence are OWNED by Cede & Co. as the Nominee for DTC. This indicates that, effectively, America is OWNED by Cede & Co.

Clearstream, Euroclear & Luxembourg

1. The Monopolistic Global reach, the legally protected control of Securities Ownership and Elite Power possessed and exercised by DTC and its Securities Ownership Nominee Cede & Co. is exacerbated on a Global scale by their working with and through their controlled European counterparts named Clearstream and Euroclear.

2. Luxembourg, being the second largest financial trading center in the World, supports the Securities Trading operations of DTC, Cede & Co., Clearstream and Euroclear, in the black, to insure the growth and ever increasing influence and ownership power monopoly of Cede & Co.

3. We will summarize these complicit organizations and their control over the financial devastation we are realizing in this last Section of the Report.

4. It is simply astounding that the system of corruption, misrepresentation and societal destruction such as the Wall Street Stock System could be designed, implemented and operated in the black for decades to the absolute detriment of both the American and World Public without being discovered, prosecuted and eliminated.

5. If this corrupt control and thievery system is to be eliminated for the benefit of the American Public, I strongly suggest that we must all ENGAGE the problem and forcibly hold accountable all those responsible.

6. If the American Public continues to make excuses and be recalcitrant, we, as a society, deserve what we ultimately get and will not be able to survive this onslaught.

7. The excuse of “Yes I know, but I can’t do anything about it” doesn’t wash any longer and is cowardly at its core.

8. Exhibit 619, Page 369, Paragraph 5 states that because DTC will be the only Registered Owner of the Global Securities, Clearstream, Euroclear and Luxembourg will hold positions, through their respective United States Depositories, which in turn will hold positions on the books of DTC.

9. Even when Securities are traded internationally, Cede & Co., through the Depository Trust Company, retain Sole Registered Shareholder ownership.

CLEARSTREAM

1. In Exhibit 619, Pages 370 to 371, Clearstream is defined as follows:

“Clearstream, as a professional depository, holds securities for its participating organizations and facilitates the clearance and settlement of securities transactions between Clearstream participants through electronic book-entry changes in accounts of Clearstream participants, thereby eliminating the need for physical movement of certificates. As a professional depository, Clearstream is subject to regulation by the Luxembourg Monetary Institute.”

2. In Exhibit 30, the Luxembourg Clearstream Depository defines itself as an International Central Depository that is based in Luxembourg that supports 53 domestic markets in 110 countries Worldwide.

3. In Exhibit 30, the German Clearstream Depository located in Frankfurt defines itself as a Domestic Central Depository that only handles German Securities that can be traded in international markets.

4. In Exhibit 30, Clearstream states that it has operated as a Central Depository for 40 Years. That is, the Clearstream System started at about the same time as the DTC and DTCC started in the United States.

EUROCLEAR

1. In Exhibit 619, Page 370, Paragraph 1, the Euroclear System is defined as:

“Euroclear System was created to hold securities for participants of Euroclear System and to clear and settle transactions between Euroclear System participants through simultaneous electronic book-entry delivery against payment, thereby eliminating the need for physical movement of certificates and any risk from lack of simultaneous transfers of securities and cash. The Euroclear System operator is Euroclear Bank S.A./N.V., under contract with the clearance cooperative, Euroclear System Clearance Systems S.C., a Belgian co-operative corporation. All operations are conducted by the Euroclear System operator, and all Euroclear System securities clearance accounts and Euroclear System cash accounts are accounts with the Euroclear System operator, not the clearance cooperative.”

2. There are two parts of the Euroclear System. These 2 parts are Euroclear Bank S.A./N.V. and Euroclear System Clearance System S.C.

3. Euroclear Bank is a Single Purpose Bank that provides Trading Settlement and other related Securities services for international Bonds, Equities, Derivatives and Investment Funds.

4. Euroclear System Clearance System S.C. is an International Central Depository that provides Custodial Depository Services for 65% of ALL the European blue-chip Equities and 50% of all European Domestic outstanding debt.

5. On July 17, 2014, Chairman Antoine Authenum announced to Clearstream Shareholders that in 2015, Euroclear and the DTCC will begin their 50/50 Joint Venture that will be located in the United Kingdom, possibly in the CITY OF LONDON.

6. This Joint Venture, with $75 Trillion in assets, will be the largest trading confederation in the world. This Joint Venture will be worth more that most of the 260 plus nations in the World.

7. See Exhibit 29, Page 2 for the Full Statement.

8. Our research efforts continue unabated because of new additional Federal Litigation being considered. It is of significant interest to note that, although incomplete at this point, facts are beginning to surface which indicate that many of the Wall Street Power Controllers discussed in this Report APPEAR to have varying combinations of both direct and indirect relationships with and allegiances to the CITY OF LONDON.

9. In Exhibit 619, Page 369, Paragraph 4 states that Purchasers of Securities in Europe may hold interests in Global securities through Clearstream, Luxembourg, or Euroclear Bank S.A./N.V. as the operator of the Euroclear System.

10. The Euroclear System was developed in December, 1968 by the Brussels Office of Morgan Guaranty Trust Company of New York.

11. Morgan Guaranty Trust Company of New York is a Wholly Owned Affiliate of J.P. MORGAN CHASE BANK.