5 Reasons Housing May Be Headed For Trouble

By Richard Barrington | Forbes

So far, home prices have been rising at a more measured pace than they were back in the frenzy of the housing boom. Still, there are at least five reasons to be cautious about the housing market.

1. The Fed is no longer keeping mortgage rates down

Quantitative easing is over. While the Federal Reserve is still keeping short-term interest rates near zero, it has discontinued the monthly bond purchases that were designed to push longer-term rates down. This was an important influence in getting mortgage rates to record lows.

So far, mortgage rates have been surprisingly stable, but without the Fed actively keeping them lower, there is no reason why normal market forces could not quickly send them higher — especially if there is a whiff of inflation somewhere along the line.

2. Prices have been rising for more than two years now

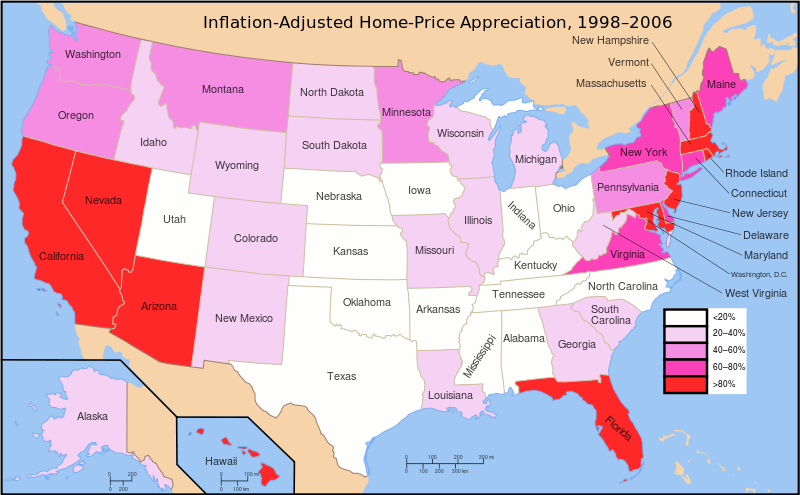

According to the S&P/Case-Shiller U.S. National Home Price Index, the housing market bottomed out in February 2012 and has been rising ever since. The good news is that prices still are not as high as they were in 2006, nor has the rise been as steep. However, the closer prices get to those levels, the more you have to ask what would make them sustainable now if they were not sustainable then.