The Economy Of The Largest Superpower On The Planet Is Collapsing

By Michael Snyder

How do you fix a superpower with exploding levels of debt, that has a rapidly aging population, that consumes far more wealth than it produces, and that has scores of zombie banks that could collapse at any moment. You might think that I am talking about the United States, but I am actually talking about Europe. You see, the truth is that the European Union has a larger population than the United States does, it has a larger economy than the United States does, and it has a much larger banking system than the United States does. Most of the time I write about the horrible economic problems that the U.S. is facing, but without a doubt economic conditions in Europe are even worse at the moment. In fact, there are many (including the Washington Post) that are calling what is happening in Europe a full-blown “depression”. Sadly, this is probably only just the beginning. In the months to come things in Europe are likely to get much worse.

First of all, let’s take a look at unemployment. If the U.S. was using honest numbers, the official unemployment rate would probably be somewhere close to 10 percent. But in many nations in Europe, the official unemployment rate is already above the ten percent mark…

France: 10.2%

Poland: 11.5%

Italy: 12.6%

Portugal: 13.1%

Spain: 23.6%

Greece: 26.4%

The official unemployment rate for the eurozone as a whole is currently 11.5 percent. The lack of good jobs is causing the middle class to shrink all over Europe, and more people than ever are becoming dependent on government assistance. European nations are well known for their generous welfare programs, but all of this spending is causing debt to GDP ratios to absolutely explode…

Spain: 92.1%

France: 92.2%

Belgium: 101.5%

Portugal: 129.0%

Italy: 132.6%

Greece: 174.9%

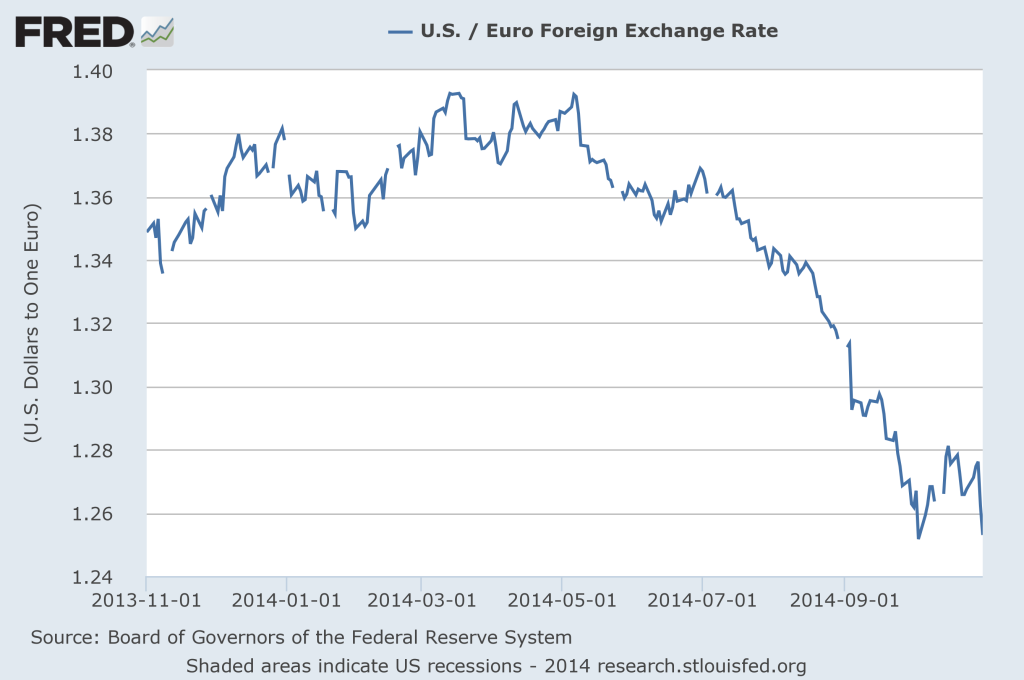

At the same time, the value of the euro has been steadily declining over the last six months. This is significantly reducing the purchasing power that European families have…