New York Times on Benefits of Gold in Currency Wars

By Mark Obyrne | Gold Core

The New York Times published an important article this week in which the benefits of gold to nation states during a period of currency wars was highlighted. The article was noteworthy as the New York Times has rarely covered gold in a positive manner.

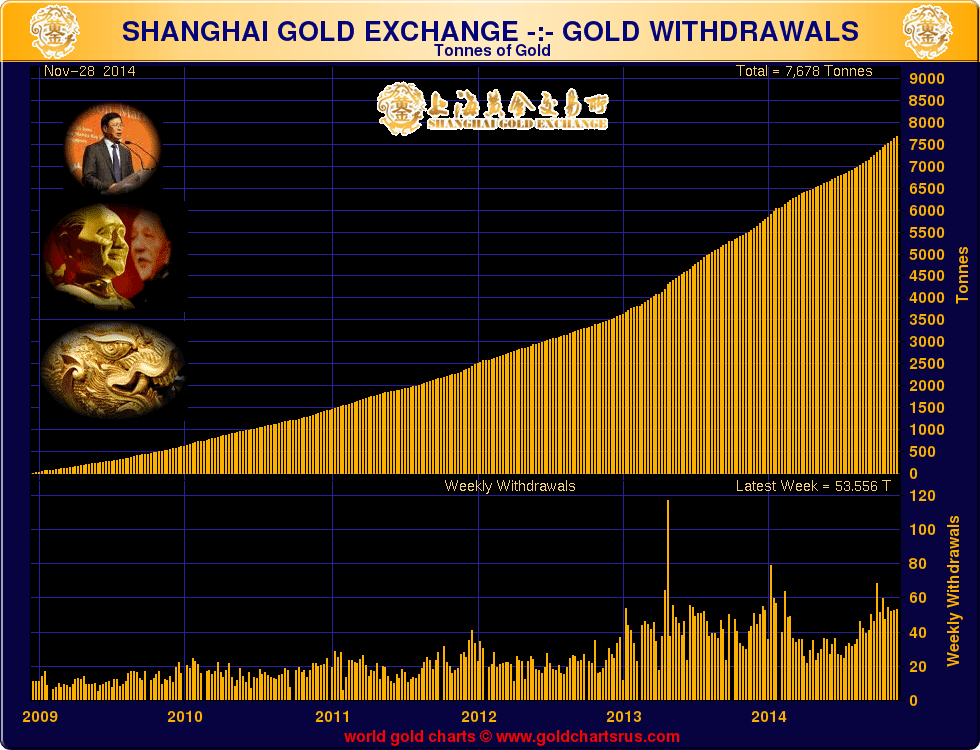

The article, entitled ‘The Golden Age’ is about the growing use of gold in geopolitical affairs. They drew attention to the gold repatriation movements in Europe and to the accumulation of the precious metals in vast quantities by the central banks of the East – particularly Russia and China.

The Times attempts to get into the mind-set of the central banks who are buying gold or attempting to repatriate their current stocks of the metal. It presents two major rationales for the current trend.

“Some that’ve interpreted the metal’s mini-comeback as an indication that financial Armageddon, in the guise of runaway inflation, is approaching. Others have read the recent move as a symbolic way for central banks and governments to make a show of strength in nervously uncertain economic times.”

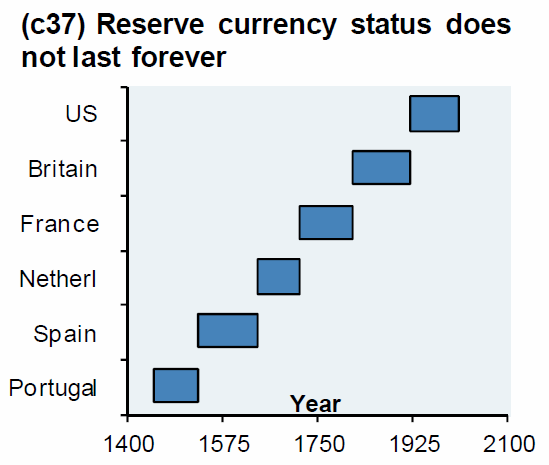

The first point is one which we have covered here consistently. The article quotes Jim Rickards who interprets the policies of China and Russia as “they understand who fragile things are and they are getting ready for the demise of the dollar.”

The Times refers to the unprecedented waves of money printing by central banks in recent years “which in theory can devalue sovereign currencies.” Despite the fact that massive money printing programs have always led to high inflation the Times seems to believe that this time it may be different – famous last words in economic terms.

The other side of the argument as put forward by the Times does not really hold water. It suggests that the accumulation of gold is a largely symbolic act . It is being used to induce a “culture of stability.”

It quotes a professor from the University of Southern California, “I doubt that the Russians or the Chinese actually believe that gold is such a great investment in terms of pure returns,” he says -“But if they are trying to suggest that they are unhappy with the dollar or that they want to become a global player, then gold is very powerful.”

He does not seem to realize that these two countries already are global players whose influence is growing as that of the U.S. declines. They may not view gold as an investment in the classic sense how they clearly view gold as an important monetary asset as seen in their declarations and in the enormous volumes they have been accumulating.